Twitter is no longer in the hands of its co-founders, Jack Dorsey, Evan Williams, Noah Glass, and Biz Stone. Elon Musk, the billionaire businessman, bought this social media platform for $44 billion. Given the change in ownership, you wonder — is Twitter publicly traded?

After all, Twitter, aka X, was a public company that allowed anyone to purchase stocks.

Today’s article covers the myriad changes on this social network in depth. You’ll learn about its current evaluation, whether you can purchase its stocks and other relevant information.

Table of Contents

Is Twitter Publicly Traded After the Buyout?

No, Twitter is no longer publicly traded after the buyout. On October 28, 2022, Elon Musk bought the social media company for $44 billion.

Mr. Musk’s interest in Twitter came to light when he became their largest shareholder in April 2022. The network’s board offered him a seat, which he accepted initially. However, he changed his mind and denied Twitter’s offer.

During the same month, he offered Twitter $44 billion to become its sole owner.

This offer was well above the social channel’s share price. Initially, the board decided to use a poison pill strategy, allowing them to purchase their shares at lower prices. This move was to prevent Musk from attempting a hostile takeover.

Finally, they accepted the deal, as this favored the interests of their shareholders. However, in July 2022, Musk attempted to cancel his offer over concerns about bot and spam accounts. He claimed Twitter’s estimates weren’t an accurate representation of the ground reality on the platform.

The social media giant disagreed with his claims and decided to sue Musk. In return, Musk counter-sued the company for misrepresenting the number of bots on the platform.

Finally, in October 2022, Musk agreed to the deal and purchased the platform. After he became the owner, he made Twitter a private company. As a result, the stocks were no longer available to purchase on the New York Stock Exchange.

This is why Twitter is no longer in the stock market.

A Closer Look at the Twitter Share Price Throughout the Buyout

When Musk offered to buy the platform, he valued the company at $54.20 per share. However, the Twitter share price was $45.08, substantially lower than Elon’s estimates. When this social media’s board accepted the offer, the stock was $51.70.

During the back and forth between Twitter’s board and Musk, the price dropped to $36.81. When he finally agreed to the deal, the stock price was $53.70.

How Did Musk Acquire the Funds To Purchase Twitter?

Elon Musk used his assets, loans, and investment funds to buy Twitter. At the time of writing this article, he is the richest person globally.

He had to sell several shares at Tesla to fund a portion of the deal. The billionaire businessman received funds from the following investment groups and individuals:

- Qatar Holding, run by the Qatar Investment Authority

- Andreessen Horowitz

- Larry Ellison, the co-founder of Oracle Corp

- Saudi Arabian Prince Alwaleed bin Talal

- Fidelity

- Sequoia Capital

- Binance

- Aliya Capital Partners LLC

- VyCapital

He also took loans from banks such as:

- Bank of America

- BNP Paribas

- Barclays

- Morgan Stanley

- Mitsubishi UFJ Financial Group (MUFG)

- Societe Generale

- Mizuho

He acquired the necessary funds to buy Twitter from its co-founders by making these moves.

What Happened to Twitter’s Board of Directors After the Buyout?

One of Musk’s first decisions after becoming the owner of Twitter, now X, was to fire the board of directors. During the prolonged buyout period, he clashed with Parag Agrawal, the former Chief Executive Officer (CEO) of Twitter.

Musk took the CEO role to help navigate the company during the transition. In the meantime, he retained the following key Twitter employees:

- Eric Fararo

- Keith Coleman

- Mary Hansbury

- Michael McGonigle

- Renato Monterio

It’s unclear who’s on the board, as the company is no longer public.

Musk posted a Twitter poll to determine whether the platform’s users wanted him as the CEO. Millions of people favored the billionaire businessman stepping down from his role.

He obliged in June 2023 by appointing Linda Yaccarino as the current CEO. Before taking up this role, she was a marketing executive at NBCUniversal. Musk took executive chairman and chief technology officer (CTO).

Why Did Musk Make Twitter Private?

Musk decided to make Twitter private for the following potential reasons:

- The social media giant no longer has to disclose its quarterly performance: A public company must share its quarterly performance data. By making Twitter, aka X, private, he doesn’t have to engage in this activity. This reduces the pressure from the public shareholders who want the company to focus on short-term gains. Also, it gives Twitter the freedom to set its sights on long-term goals for its business and investors.

- It reduces administrative costs: Another common reason to make a company private is to reduce administrative costs. Public companies need to spend their capital and resources complying with government regulations. They also have to pay various fees to file their quarterly performance reports. By stopping these activities, Twitter has more time to focus on itself.

- The owners can make changes without public scrutiny: After making Twitter a private entity, they have complete control over it. This enables them to make substantial changes to the platform without involving its public shareholders. With this freedom, they can take action to turn things around. In other words, this move gives Musk loads of flexibility to take the platform in a different direction.

Changes in Twitter Price Under the New Ownership

Twitter price fluctuated substantially after the company became private. Gathering data about the company’s performance is challenging, as this information is no longer public. However, there are several reports which will give you a clue of what’s going on at X:

- In June 2023, Fidelity, one of Twitter’s investors, increased the value of its stake by 11%. This indicates that the social media network is worth $27 billion. However, the previous month, May 2023, the valuation was $15 billion, substantially lower than the buying price.

- Fast-forward to 2024, and Fidelity reduces its stake evaluation even further. The mutual fund believes X’s evaluation is 71.5% lower than the original purchase price.

- According to Fortune, Twitter is worth $19 billion. The global business news company acquired screenshots of X’s equity compensation plan. They observed the social media network offering employees restricted stock units (RSU) at $45 per share. This indicates the platform lost more than half its value under the new Twitter leadership. However, you should know that private companies can offer their stocks at lower prices to make their compensation enticing.

- In 2023, Twitter didn’t hit its $3 billion goal in ad sales. Instead, it received $2.5 billion from this part of its business. Due to all the loans from multiple banks, X has to pay over $1 billion as interest every year.

What does this mean? These figures may not be 100% accurate, as every shareholder may use different techniques to evaluate X. As a result, each investor’s evaluation will vary.

Can You Still Buy Twitter Stock Even Though the Company Is Private?

No, you can no longer buy Twitter stock as it is no longer in any public market. The only direct options available to the social channel’s employees are restricted stock options.

There are indirect ways to invest in Twitter, as highlighted below:

- You can invest in private equity firms with a stake in the social media giant.

- The second option is to become an accredited investor. However, you need a net worth of over $1 million without considering your primary residential asset. If your annual income exceeds $200,000 as an individual or $300,000 as a couple, you can become an accredited investor.

However, you should be okay with taking substantial risks and investing large amounts of capital for several years.

4 Finance-Related Changes Under Musk’s Ownership

Since Musk became the owner of X, the social media channel underwent the following four changes:

- The new leadership fired Twitter’s top executives like Parag Agrawal, Vijaya Gadde, and Ned Segal. They also laid off nearly 80% of the platform’s workforce to reduce costs and keep their teams agile.

- X started moving away from advertising revenue and focused on its subscription service. The platform’s subscription plan, X Basic, starts at $3.99 monthly if you subscribe from your desktop browser. This service gives users exclusive features to enhance their experience on this social channel. It also replaced the legacy verification system, allowing everyone to apply for the blue checkmark.

- The social network introduced Verified Organizations, a subscription service for businesses that offer exclusive features, such as boosting reach, gold checkmarks, X Premium for every affiliate, and more. Verified Organizations start at $200 per month in the U.S.

- Musk moved the servers from Sacramento to Portland to reduce the operating costs of keeping these systems online. However, the sudden movement of the X’s infrastructure and the servers going offline affected the platform’s stability for several months.

TweetDelete: Stop Your Tweets From Affecting Your Twitter Earnings

You finally have the answer to this question — is Twitter a publicly traded company? The platform is undergoing significant changes after becoming private. Musk will have to take Xpublic, as his investors will want a return on investment (ROI) to back him financially. Or, the social media giant can go in a different direction.

X allows creators to generate revenue by regularly posting on this social media network. The amount depends on how many impressions the ads generate in the comments section of your posts.

If you tweet something your audience doesn’t like, people may not engage with your content. Similarly, they may also avoid your tweets when you continue posting content along the same lines. This affects the revenue you generate via impressions.

How do you solve this issue? The easiest solution is to delete such tweets and change your content. However, deleting multiple posts is no easy task, as you need to remove each post individually.

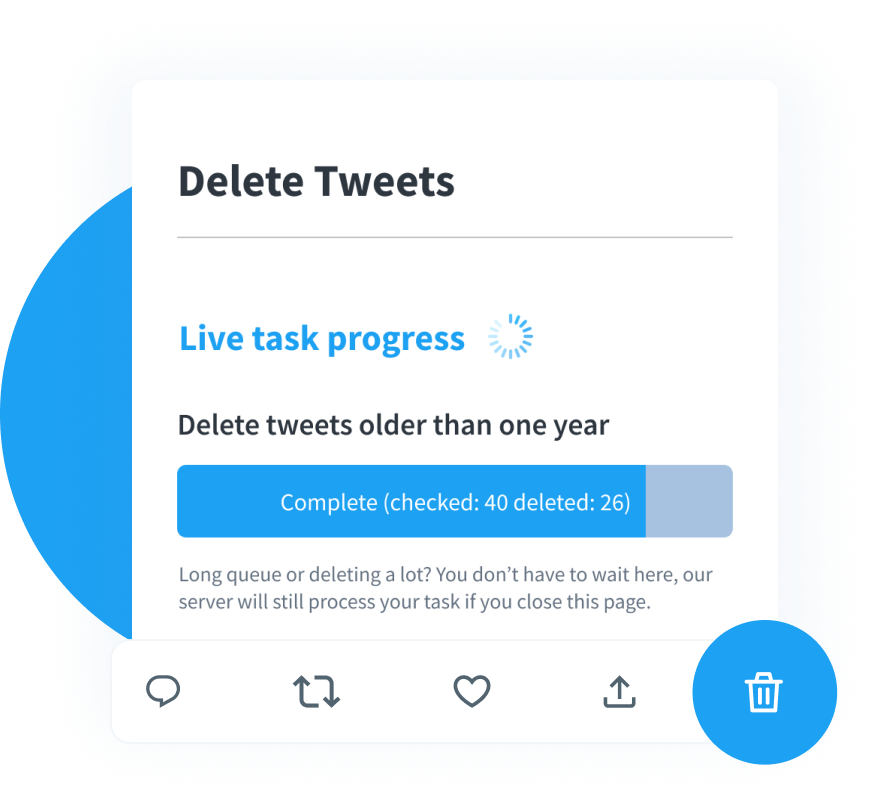

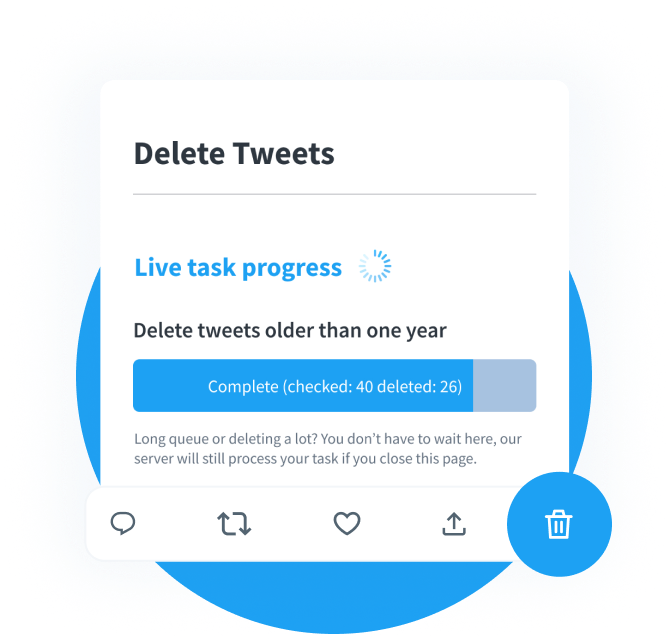

With TweetDelete, you can quickly remove as many tweets as necessary. This is possible with the mass-delete tweets feature, which has no limitations on how many posts you can delete. There’s also the auto-delete task, which removes posts without any clicks. It finds the tweets you want to erase based on the keywords, date range, and hashtags you provide.

Next time anyone asks — is Twitter publicly traded? You can point them toward this article.

Ensure certain tweets don’t affect the revenue you generate from X by becoming a TweetDelete member today!