Twitter has undergone several changes since Elon Musk acquired the platform in 2022, including its rebranding to X. However, while many of the changes affected the platform, a lot more affected its managerial and business status. That is visible from the change in CEO to the massive layoffs and privatization. Nevertheless, the business now promises higher profitability, attracting investors asking, “Is Twitter on the stock market?”

Many tweeps and investors have concerns about Twitter’s buyout and how it affects its presence on the stock market. They also express concerns about the value of X stocks and the future of the business. Therefore, this article discusses everything you need to know about Twitter stocks and their availability on the market.

Table of Contents

Is Twitter Still on the Stock Market? Can I Buy Twtr Shares?

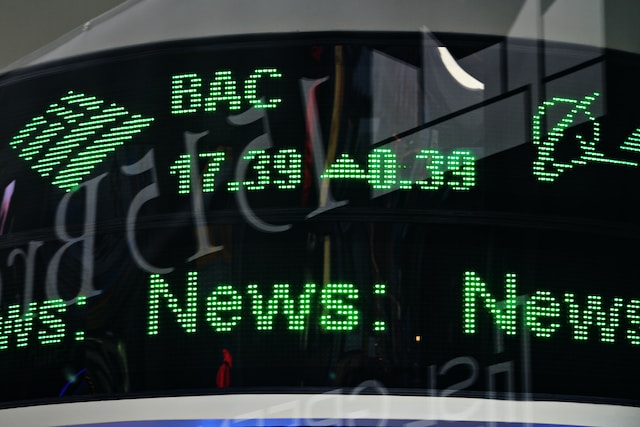

Although Twitter, now X, surfaced in 2006, it only became a public company in 2013. That is when Twitter entered the market with shares available to willing buyers and investors. From 2013 to 2022, the New York Stock Exchange listed Twitter for trading with the ticker symbol TWTR. But is Twitter still on the stock market?

Unfortunately, Elon Musk, the then-CEO, made the company private after acquiring the platform. This change delisted Twitter from the stock market. Thus, you can no longer trade Twitter stock in the market.

Nevertheless, that does not mean you cannot buy TWTR shares. Even as a private company, you can still buy Twitter shares, just not on the market. To get TWTR shares, you must find a shareholder willing to sell his share.

The buying and selling of delisted shares are quite tricky. Usually, it’d be cheaper to acquire delisted shares because the seller receives few offers when selling over the counter. However, for TWTR, with such a bogus promise, the vice versa may be the case. This is because all investors desire to hold on to their shares.

What Happened to Twitter Stock? Should the Investors Worry?

With the company’s privatization, Twitter automatically delisted from the stock market. After that, you may wonder what happened to Twitter Stock. Interestingly, Twitter voluntarily left the market to go private. Unlike other tech companies that fail to meet listing requirements or who go bankrupt, Twitter shares may not devalue. So, investors should not necessarily worry about their TWTR shares.

Moreover, 98% of X shareholders favored the buyout, so it did not affect the stock values. TWTR stocks closed as a public company at a fair price of $53.70. With an increasing market cap, selling shares over the counter would favor the sellers, who are now price setters.

How Much Is Twitter Worth on the Stock Market?

Twitter is no longer on the stock market. It is now a private company delisted from the stock exchange market. So, instead of asking, “How much is Twitter worth on the stock market?” find its value over the counter. You can only get X shares directly from current investors, who will sell them over the counter. Still, Twitter closed as a public company on the NYSE list at $53.70 per share. However, the new private investors were able to sell their shares at $54.00

However, if you’re only interested in the business’ growth, you can discern that by analyzing its annual market capitalization. Twitter’s market cap experienced significant fluctuations during the buyout and shortly afterward, which caused a decline in its capitalization. Since then, Twitter has been on the road to recovery, trying to build the value for which Musk bought it.

Though not an easy road, it is a promising one. Twitter remains an excellent social media platform with several unique features that set it apart. It attracts a creative and engaged demographic that is responsive to change. That makes it easy for the new business leaders to implement new features that aim to develop the platform. Valued at $41.09 billion in December 2023, Twitter will soon reach and exceed its buyout price.

Is Twitter on the Stock Market? Why Did It Leave?

Twitter left the market because of its takeover, leading to the company’s privatization. Once private, it can no longer appear on the stock exchange market. But you may wonder why X would go private despite the several perks of remaining publicly traded. The answer lies in the cost of acquisition and the need to start profiting soonest.

While acquiring Twitter, Elon Musk accrued billions of dollars in debt interest, which he needs to begin repaying immediately. Thus, privatizing the company was the easiest way to gain control and implement monetization policies to help offset this debt. Now you understand why the verified badge has a price and why third-party API had to go. Twitter can only implement profitable ventures, even though it slightly affects its core values.

While the primary goal is to break even, the new owner has extensive plans to revolutionize the platform. Unlike Meta, acquiring several platforms to gain greater customer reach, Musk desires to build an all-in-one app. That is why he rebranded and privatized Twitter under X corporation – laying a foundation for exponential growth.

Will Twitter Return to the Stock Market? Is There Any Hope?

Many delisted companies return to the stock exchange market soon after getting back on their feet. For these, the perks of being a public trader are too good to miss. However, the case is a little different with Twitter. For X, exiting the market was voluntary, not influenced by any deficiency or limitation. As the preceding section shows, the owner privatized and delisted Twitter to gain full business control.

Therefore, there is a good chance that he may still desire that control after breaking even. Besides, the rebranded platform may take a while to assume its intended function ultimately. The all-in-app will take time to build and gain users’ positive reception. Until then, Twitter will likely remain a private business, delisted from the stock market.

Nevertheless, you cannot completely rule out its return to the market; only time can tell. No one ever imagined that such a thriving business on the NYSE would go private overnight, and yet it happened with a simple buyout. Similarly, another ownership or administrative control change might return the social media company to the market.

Twitter Privatization and Delisting: The Effects on the Business

If you followed the story of Twitter’s buyout, you may assume that Musk learned his lessons about due diligence. It’s funny to learn that he offered a hefty sum for Twitter before researching the platform. Then, he tried to back out of the deal, but the law forced him to follow through with it.

Now, he has quickly privatized Twitter despite the benefits it enjoyed as a public company. From previous experience, you may wonder whether he did the research first this time. Whatever the case, the section outlines some effects of the privatization. Undoubtedly, he may have targeted some of these effects, but there are others he may not have considered.

Dissolving the Board of Directors and Cherry-Picking Top Executives

Before his takeover, Musk had huge shares, like other top shareholders, that earned him a seat on the company’s board. However, that wasn’t enough; he sought total control over the company and not just a voice in its administration.

Therefore, he launched the buyout to own all the shares or share them with people who would let him rule. Thus, after the acquisition, the directorial board no longer existed. That is because Musk theoretically controlled all of the company’s share, save for his few supporters and allies.

With the dictatorial control now his, he could freely choose the company’s top executives – people who obey his every directive. That didn’t take time, as many veteran executives lost their positions.

Employee Layoffs and a Changed Work Environment

With the buyout and privatization of X, not only did top executives lose their jobs, but The Musk administration laid off about 80% of the company’s workforce, amounting to 6,000 employees. However, what did you expect if the new administrator did not spare the top executives?

Even for the retained employees, questions about their working conditions and compensations arise. As a public company, employees received stock options from the company. With Twitter off the public markets, existing stock owners have chased out their shares. Still, there’s no new employee compensation method drafted yet.

Receding Possibilities for Trading X Stocks

You’ve learned that you can still buy and sell Twitter stocks, although they are no longer on the market. However, those are only theoretical facts generally applied to privatized companies that the exchange market delists. The case for Twitter is slightly different, considering its unique reason for privatization.

Remember, Twitter went private after a buyout and takeover with a primary aim for control. Now, Elon Musk and his friends own all Twitter shares. Do you think they’ll sell it over the counter for anyone? Not really. So, while it is theoretically possible to still buy Twitter shares, you can’t buy what’s not for sale. The only hope for finding Twitter shares for sale is when Twitter returns to the market.

The Dawn of New Financial Pressures for Twitter

You’ll agree that the main reason for Twitter’s swift privatization under Elon is to avoid scrutiny, especially from the public. As a public company, X had to make quarterly disclosure of its business health for transparency to public investors. Undoubtedly, Musk would not want such an exposure level for the direction he wanted the company to run. So, privatization was the best option for him. Now, he and a few friends can decide what happens, even argue, but all in a closed room.

However, with the public pressure off X came weighty pressures from the financial institutions and equity investors. These were Musk’s sources for the billions he used to acquire Twitter, and they must have their money back soon. The effect of this pressure is now evident in the intensified monetization of Twitter features. So, Twitter privatization said goodbye to public pressure but welcomed private pressure!

Monitoring Twitter Stocks and Preparing for Future Changes

Elon Musk remains a businessman at heart and will only do what is profitable, even with X. He’s not one for sentiment with assets, nor does he take a die-hard stance on a position. Currently, he made Twitter private for business reasons, as you’ve learned. So, there’s a good chance he might swing with the tides to go public when that favors the company best.

So, if you’re still interested in getting X stocks, the time to prepare is now. Consult your broker and start saving capital for your investment. For now, you’re better off enjoying the platform to learn about what you’re investing in. Create a Twitter account and stay active to learn about all the features and the platform administration. On X, you can learn more about your query, “Is Twitter on the stock market.”

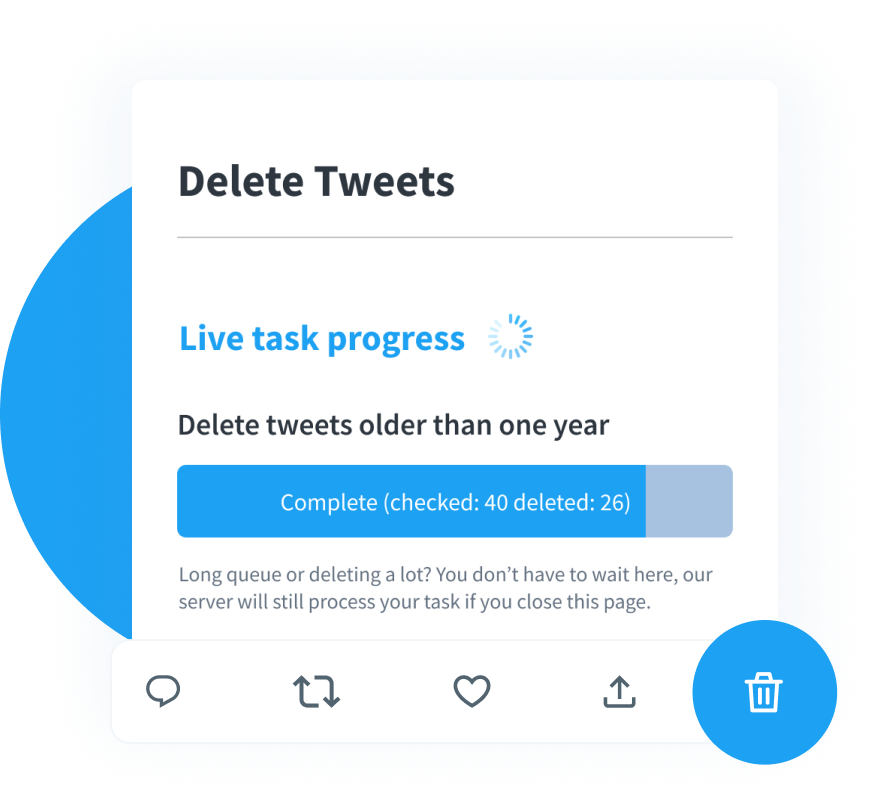

You can also use third-party tools like TweetEraser for Twitter management on your account. This web-based tool lets you bulk-delete posts from your timeline with a single click. It is easy to use, even for beginners, and affordable. TweetEraser offers free and premium versions with varying levels of effect. It does not promote distractive advertisement when in use. With TweetEraser, you’ll keep a clean and attractive profile for potential followers. So start filtering and cleaning your Twitter timeline today!