When Elon Musk purchased Twitter, aka X, for $44 billion, he didn’t do it alone. He had the backing of several Twitter investors, who gave him the capital to complete the takeover. How is the social media platform holding up several years after the change in ownership?

Get the answers to these questions and other similar queries in this article. It also explains what you should do to find investors for your business. So, without further ado, let’s get started!

Table of Contents

Who are Twitter Investors? A Closer Look at X’s Financiers

At the time of the initial bid, i.e., April 2022, Elon Musk was the richest individual on this planet. Despite his immense wealth, he required the help of several investors to acquire Twitter from its previous owners. Here’s a list of multiple Twitter investors.

1. The Billionaire Investors

Here’s a list of all the billionaires with interests in Twitter, aka X:

- Elon Musk: It’s no surprise that Elon Musk is the biggest investor, having personally contributed $33.5 billion to the deal. He also offered over half of his shares in Tesla to acquire the social media platform. By April 2022, he acquired 9.1% of Twitter’s shares, making him the largest stakeholder.

- Prince Alwaleed bin Talal al Saud: Prince Alwaleed bin Tala al Saud, a Saudi prince, is another billionaire investor who helped Musk purchase Twitter. He converted almost $2 billion of his shares after the social media giant became a private company under Musk.

- Jack Dorsey: The co-founder of Twitter, Jack Dorsey, invested $1 billion in Musk’s new vision for the social media platform. He believed Musk was the person to change Twitter and take it in a new direction.

- Larry Ellison: Although Larry Ellison, the founder of Oracle, isn’t active on Twitter, he still invested $1 billion on this platform. He did so through Lawrence J. Ellison Revocable Trust, which holds and manages his assets.

2. Investment Firms, Cryptocurrency Exchanges, and Banks

The following financial institutions backed Musk to buy Twitter:

- Sequoia Capital: Sequoia Capital, an investment firm with a well-renowned portfolio, funded $800 million. They have vested interests in Musk’s other companies, such as The Boring Company and SpaceX.

- Vy Capital: Vy Capital is another investment firm that backed The Boring Company. They invested $700 million in the social media channel.

- Andreessen Horowitz: Andreessen Horowitz’s impressive investments explain the firm’s interest in Twitter. The company’s co-founder pledged $400 million to ensure the deal goes through.

- Qatar Investment Authority: Qatar’s sovereign wealth fund makes several investments as part of its efforts to strengthen its country’s economy. The group provided Twitter with $375 million.

- Binance: Binance, a popular cryptocurrency exchange, gave $500 million to Musk’s Twitter. They became interested after hearing about Musk’s initial bid to purchase the platform.

- Bank of America, Morgan Stanley, MUFG, Société Générale, Mizuho, BNP Paribas, and Barclays: Banks loaned Musk $13 billion as the interest on the deal will help earn $1 billion annually. However, due to the inherent risk of purchasing a social media platform, they asked Musk to provide significant collateral. The billionaire investor put most of his Tesla shares on the line to acquire the necessary capital.

3. Miscellaneous Investors Revealed During a Court Case

Knowing all the investors is challenging because the social media company is private. However, this changed due to the Reporters Committee for Freedom of the Press. They filed a motion against Twitter, which revealed all the investors that backed Musk’s buyout of Twitter.

Here’s a list of some of the shareholders:

- Sean Combs, aka P-Diddy, via Sean Combs Capital.

- Ross Gerber and Danilo Kawasaki, Gerber Kawasaki Wealth and Investment Management co-founders.

- Scott Nolan from Founders Fund and a former engineer at SpaceX.

- 8VC is a venture capitalist firm co-founded by Joe Lonsdale.

Twitter’s Valuation Two Years After the Buyout

Unfortunately, Twitter or X’s valuation doesn’t look good two years after the buyout. Under the new Twitter leadership, the platform underwent significant changes. For instance, most employees, i.e., 80% of X’s workforce, no longer work for the company.

There was also significant friction between the new owner and advertisers. Several big brands, such as Apple, Disney, and IBM, stopped advertising on the platform after Musk shared an offensive post.

Media Matters, a nonprofit journalism watchdog, published a report highlighting issues with X’s advertisements. They claimed that ads from various brands appeared next to offensive and hateful content.

As a result, over 200 companies paused or stopped their marketing campaigns on the platform. This was a significant problem for X, as 90% of its revenue comes from advertisements. Moreover, the new leadership overhauled the legacy verification program. They bundled user verification with X Premium, the platform’s subscription service.

Despite the moves to reduce costs and increase revenue, Fidelity Investments, a minor investor, decreased its stake valuation by 79%. This indicates that Twitter, aka X, has a value in the eyes of Fidelity at $9.4 billion.

Prince Alwaleed bin Talal al Saud, a major investor in Twitter, is still positive about the social media channel. Also, it’s important to note that X is still a private company. Due to this, it’s not easy to know the platform’s true value.

How To Find Investors on Twitter: 3 Tips To Get Started

If you have an idea or you’re running a business, it’s vital to get investors. They’ll give you the capital to help you achieve your goals for your concept or company. Here’s a guide explaining the process to find investors on Twitter:

- Create or follow Twitter Lists: Twitter Lists are custom feeds where you can see posts from specific users. With lists, you can see what investors post on X and get ideas about their interests. It helps you determine whether an investor is a good fit for your brand or business idea.

- Keep an eye on news channels, market experts, and thought leaders in your industry: Another option is to look at accounts that cover finance-related topics like thought leaders, market experts, and news channels. Following these accounts helps you understand the market and who to approach.

- Join Twitter communities focusing on investment: Investment communities can give you insights on who to approach to back your business. Participate in these communities and connect with like-minded X users.

How To Connect With Investors in Twitter: Follow These 4 Tips

Connecting with investors on X can open new doors and change your business’s trajectory forever. However, the question is — how do you connect with these stakeholders in the first place?

Use the following tips for Twitter for investors:

- Give your profile a professional makeover: The first order of business is to analyze your Twitter account and make it look professional. There shouldn’t be any missing details or irrelevant information. Your Twitter or X bio should be similar to your elevator pitch. Include links that direct interested parties to your website.

- Go through an investor’s account page: You need to know about the investor before you ask them to back your business. Their X account can give you insight into their interests and risk profile. Also, you may find their contact information or website, where you can reach them to talk about your business.

- Take part in conversations relevant to your niche: If the investor is active on Twitter, you must participate in relevant online conversations. If they’re active in a discussion, weigh in with your expertise to make your opinions stand out. You should also get X Premium, as the subscription service boosts your replies.

- Post regularly: You must share high-quality information about your niche via your tweets regularly. This showcases your understanding of your industry. Moreover, investors are more likely to share your posts, allowing you to connect with them.

Don’t Let Your Older Tweets Affect Your Investment Opportunities

Twitter may be sailing rough seas as of October 2024 due to a significant decrease in advertising revenue. However, the platform can correct its course as the new leadership continues to make substantial changes.

Your older tweets can say a lot about who you are as an individual or a brand. If you’re looking for investors, you must first clean your X account. Older tweets that are controversial, bad takes, offensive, or insensitive hamper your chances of landing investment opportunities.

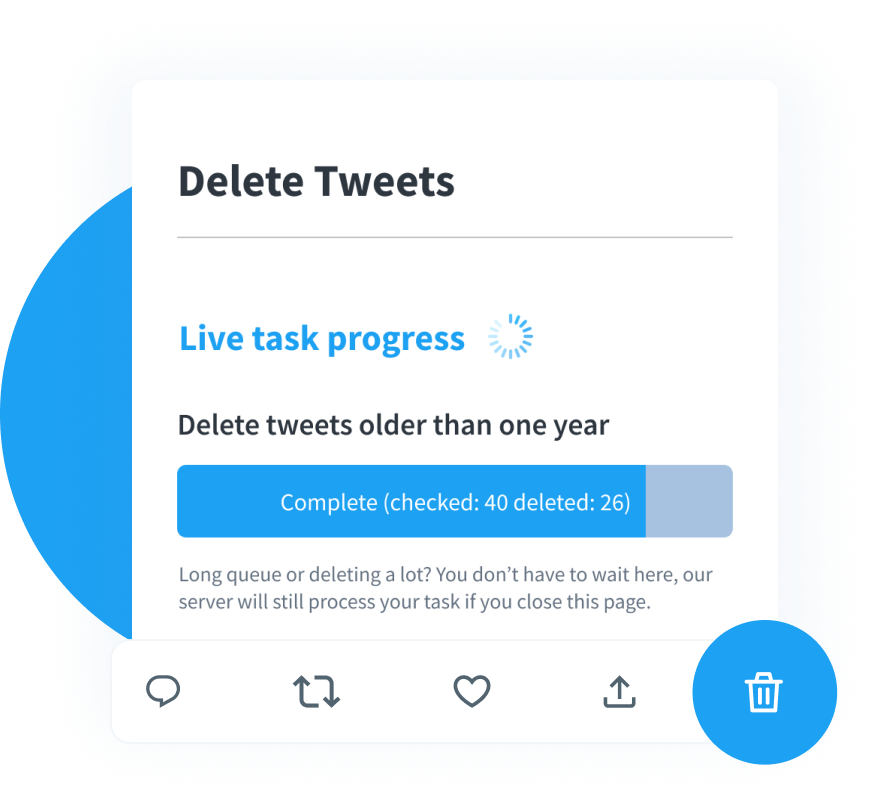

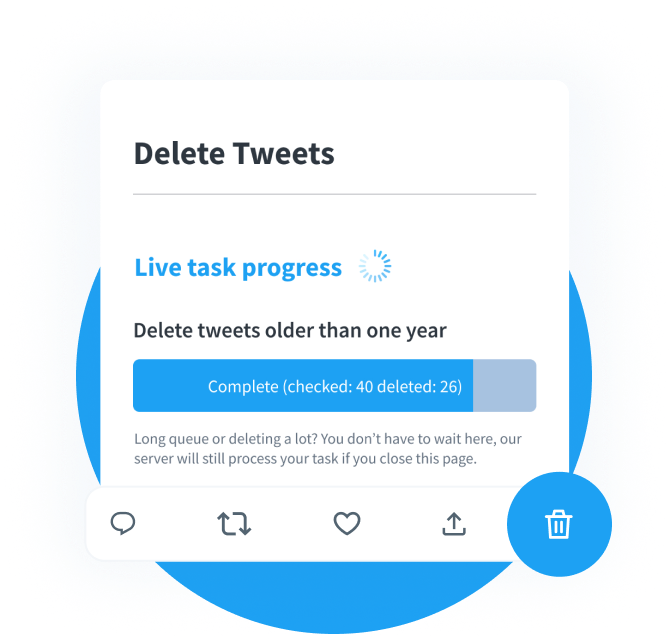

TweetDelete makes removing your older posts from your profile page easier than ever. The custom filter ensures you will find any tweet in your account. It can filter posts based on tweet type, date ranges, keywords, and hashtags.

With the bulk-delete tweets utility, you can remove multiple posts with a single click. There’s the auto-delete tweets task, which erases unwanted tweets in the background.

Use the unlike tweets feature to delete your likes so your actions on X don’t affect your credibility.

Join TweetDelete today to ensure your profile looks appealing to Twitter investors!

FAQ on Investors for X

In this section, you’ll find answers to queries about investors and X:

How much did Elon Musk pay to buy Twitter?

Elon Musk paid $44 billion to buy Twitter, a publicly traded social media company. Several investors backed Musk financially to make the deal possible. One of the first moves after buying Twitter was to take the company private.

Was Twitter profitable before the takeover?

No, Twitter wasn’t profitable before the takeover. In 2021, the social media channel reported a $221 million loss. The company was only profitable in 2018 and 2019.

Who sold Twitter to Elon Musk?

Twitter’s board of directors sold the social media platform to Elon Musk. The billionaire investor initially offered $44 billion, and the board was against the idea of selling. However, they changed their mind and forced Musk to purchase the platform after filing a lawsuit.